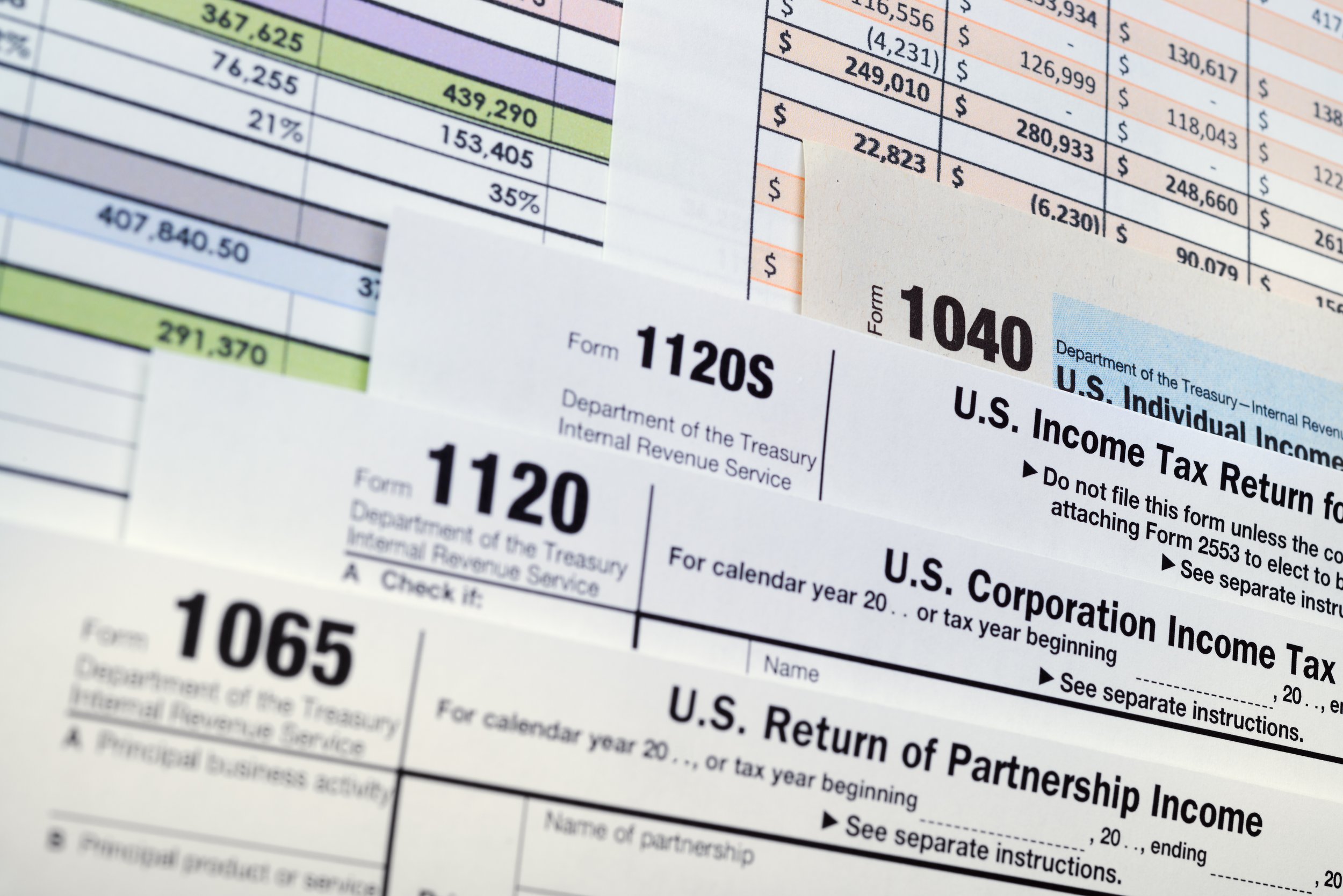

Tax Compliance

Complying with tax regulations doesn’t have to be complicated.

Working in today’s constantly shifting regulatory environment can feel burdensome, but with our planning and filing services, we can advise you through the entire tax compliance process.

At Patrick A Mulroy Consulting LLC, an experienced CPA will not only meet your tax compliance needs utilizing the latest capabilities in tax technology and from a forensic accountant mindset, but will also prioritize your unique business goals using our industry-specific knowledge to render actionable insights during the process.

How could your business benefit?

Reduce Risk and Improve Efficiency

Manual processes such as updating spreadsheets can be risky, and that’s why our tax professionals use the latest technology to ensure you are keeping up with the ever-fluctuating tax laws and compliance regulations, and looking for non-compliance risk that may have gone unidentified. Let our platforms keep up with these changes so you can focus on what makes your business succeed.

Gather Actionable Insights

As our tax professionals help you analyze your tax data with our platforms, you’ll gain valuable insights that could lead to tax savings and planning opportunities.

Meet Deadlines

Our team will collaborate with you to meet the strictest of deadlines via clear communication. With our services, you will be able to easily stay ahead of timely compliance requirements.